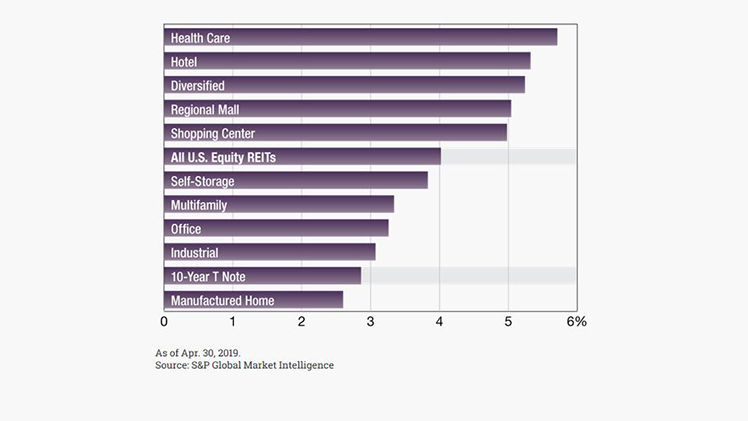

| The above chart shows you one-year dividend yields of publicly traded U.S. Equity REITs, as of April 30, 2019. One-year average dividend yield is 4.0 percent. The Multifamily REIT sector yield is about 3.4 percent, whereas the Health Care REIT sector posted the highest one-year average dividend yield among the group, at 5.7 percent. Until 2013, if an individual investor wanted to passively invest in US Real Estate, the best way to do it was to invest in a REIT (Real Estate Investment Trust), at much lower yields and with no control over where your funds are deployed. You would typically pick a sector REIT and invest. However, the JOBS Act in 2013 added new sections 506(b) and 506(c) to Rule 506, which opened up the opportunity for Sophisticated and Accredited investors to invest passively in commercial real estate deals through syndicated private offerings, similar to the investment opportunities we bring to you. Why Private Offerings?More Control In private offerings, as a passive investor one can choose and pick deals and individual properties, that are best aligned with their individual investment goals.Higher Returns The average annual returns/yields are typically higher in private offerings than publicly traded REITs, and even as a passive investor you participate in the upside, upon sale of the asset. Higher Tax Savings There are higher tax savings in multifamily active or passive investing. They range from depreciation, cost-segregation, tax treatment of passive income , 1031 exchange for tax deferral.Greater Accountability Passively investing in deal based private offerings, make the sponsors of the deal directly accountable to a small set of private investors they’re pitching the deal to. Plus the deal sponsors are also easily approachable to the investors.Stronger Partnership The relationship between a deal sponsor and passive investors is more of a partnership, as most of the times the deal sponsors invest their own money in the deal too. The number of investors in a typical private offering syndication would range from 50-100, whereas a REIT would have millions of passive investors.  Money won’t create success, freedom to make it, will – Nelson Mandela Financial independence is about having more choices – Robert Kiyosaki Happy July 4th!! |

Information bias in Investing

Information bias refers to a discrepancy that arises when the data collected or measured by an individual doesn’t accurately represent the inherent reality. This discrepancy