Resources

Thought Leadership

Information bias in Investing

Information bias refers to a discrepancy that arises when the data collected or measured by an individual doesn’t accurately represent the inherent reality. This discrepancy

Top 5 trends shaping retail real estate in 2024

1. Suburbs will continue to dominate in 2024 due to housing affordability, migration within large MSAs and, employers moving to remote or hybrid work model. 2. Green ESG initiatives that lower

Value vs Growth

We often hear top analysts say that growth and value are mutually exclusive. If you’re looking for growth in an investment then one needs to

Savings account, a destroyer of wealth!?

Is a savings bank account even relevant in today’s time? In Europe, savings banks formally originated in the 19th and may have existed in some

2023 Retail trends & outlook

Phoenix is an immortal bird associated with Greek mythology (with analogs in many cultures) that cyclically regenerates or is otherwise born again. Most cultures associate

Fiscal v/s Monetary Policy – recession in 2022!!

Everyone these days have probably heard the terms fiscal policy and monetary policy, but what exactly are they? Fiscal policy and monetary policy refer to

All you need to know about crowdfunding real estate investment

Crowdfunding real estate investment is a great way to get started with investments and generate a passive income. However, to get a surplus, it is

What are the Advantages of Real Estate Crowdfunding?

Crowdfunding, from an investor’s standpoint, gives access to an increased number of investment opportunities and flexibility to diversify any investment portfolio. One could spread a

Investing in Cash Flow: The Benefits of Investing in Times of Economic Uncertainty

Our current economic state is one of great uncertainty. While it’s not easy to predict what the economy will do next, investors must make decisions

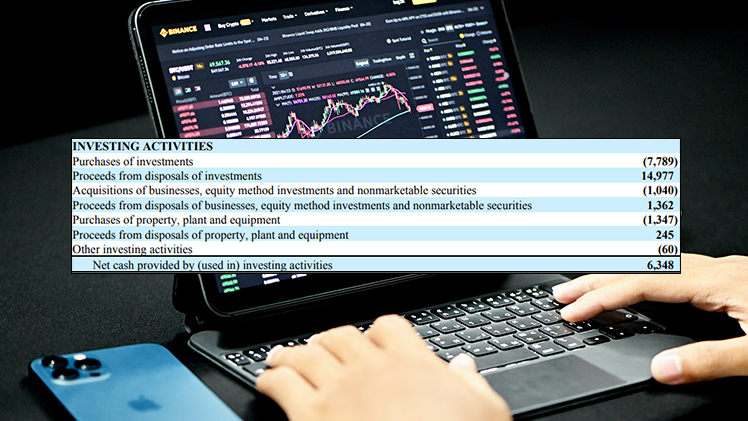

The Relevance of Cash Flow in Investments

The component of a Cash Flow Statement (like the example shown above) that details how much money was made or spent on various investment-related activities

Ten Reasons to Consider Real Estate Crowdfunding

If you’ve read headlines about people investing millions of dollars in brand-new real estate developments, buying exclusive investment properties, or closing on multi-million-dollar real estate

Should You Invest in the Stock Market or Commercial Real Estate?

Let us discuss money… Making money is one thing but keeping and growing it is quite a challenge. Billions of dollars are spent by financial

Women…..real architects of society

Women’s History Month is a celebration of women’s contributions to history, culture, finance, and society. It has been observed annually in the month of March

The real WHY behind generational wealth?

“I didn’t have it, but I want my children to have it all” – Does this sound familiar? Be it money, wealth, comfort, education, or

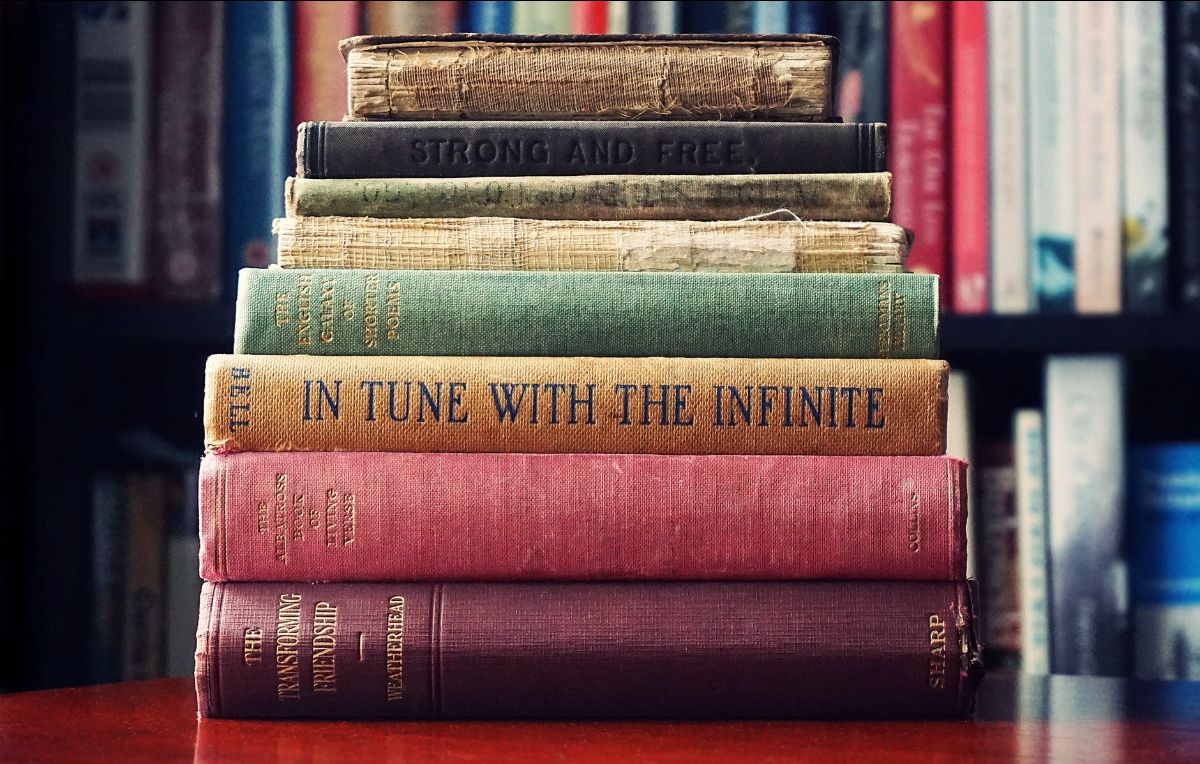

Wisdom from great investors

Successful investing in any asset class requires patience, discipline and the ability to control one’s emotions. Here are some of the best investment minds in

7 Mistakes High Net Worth Investors Avoid

The wealthy, who are also known as High Net Worth Individuals (HNWI) have a net worth higher than $5 million and, Ultra High Net Worth

Are we caught up in the Twin Trifecta?

Trifecta combines the prefix “tri” meaning three, with the last element in “perfecta”, a word of American Spanish origin that refers to a horse-racing bet

Will your money outlive you?

Retirement is often one of the most common, yet important goal that people have. Your retirement savings will determine how comfortably you will live and

2021 U.S. and California Forecast, and our thoughts

As Chapman University’s forecasting has consistently outperformed agencies and institutions participating in the Blue-Chip Economic Indicators Survey, the university’s Economic Forecasts are must-see events for

How do we think outside the box?

In the year 1942, Albert Einstein was teaching at Oxford. One day, he gave a physics exam to his senior class students. While he was

How to create wealth using the 7r theory?

Bruno and Pablo were two ambitious cousins living in a small town. One day the mayor of that town came to them and said there

Invest for the greater good

Working towards our financial goals is great. If we keep working at it and continue to take action, the results could be phenomenal. But how about

Investing in net-lease properties

When someone buys an Apple product or a Tesla car, they aren’t primarily doing so for their advanced features, ease of use, cutting edge design, stylish looks, but because

Inflation impact on time value of money

It can be tricky to grasp the real impact of inflation on our money. Inflation, effectively shrinks the value of money over time, making it

Multifamily v/s Stocks – a 19 year progress report

Investment decisions tend to become complicated when one does not clearly know why, how, what, and where to invest their surplus income or savings. There

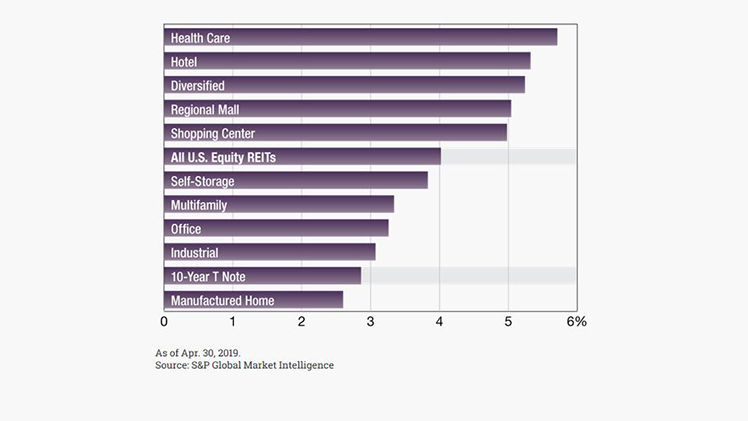

Financial independence is all about choices

The above chart shows you one-year dividend yields of publicly traded U.S. Equity REITs, as of April 30, 2019. One-year average dividend yield is 4.0 percent.

What are opportunity zones?

“A Qualified Opportunity Zone is a census tract of low-income areas nominated by the state and certified by the Secretary of US Treasury, via delegation of authority

Prepare for the next real estate downturn

If one thinks of investing in real estate, the most common trend is, to buy a value-add single-family residence (SFR). Investing in SFR for consistent positive cash flow

Knowledge Base

An accredited investor, in the context of a natural person, includes anyone who:

- earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, OR

- has a net worth over $1 million, either alone or together with a spouse or spousal equivalent(excluding the value of the person’s primary residence), OR

- is a financial professional who holds in good standing a Series 7, 65 or 82 license. Consult FINRA rules and applicable state rules.

There are other categories of accredited investors, including the following, which may be relevant to you:

- any trust, with total assetsin excess of $5 million, not formed specifically to purchase the subject securities, whose purchase is directed by a sophisticated person, OR

- certain entity with total investmentsin excess of $5 million, not formed to specifically purchase the subject securities, OR

- any entity in which all of the equity owners are accredited investors.

A sophisticated investor refers to one of the categories of an individual or an institution with vast market knowledge and experience in both financial and business matters in addition to significant wealth and income streams.

Due to their high net worth and knowledge, sophisticated investors are able to access certain investment opportunities that are not available to all investors.

Until 2013, if an individual investor wanted to passively invest in US Real Estate, the best way to do it was to invest in a REIT (Real Estate Investment Trust), at much lower yields and with no control over where your funds are deployed. You would typically pick a sector REIT and invest.

However, the JOBS Act in 2013 added new sections 506(b) and 506(c) to Rule 506, which opened up the opportunity for Sophisticated and Accredited investors to invest passively in commercial real estate crowdfunding deals through syndicated private offerings.

Yes, you can invest passively in real estate if you IRA, 401(k) plans are self-directed. If you’re an individual who knows and wants to manage how and where your retirement savings are deployed, the self-directed option could be ideal for you. This is a great option for individuals who would like to directly invest their savings in real estate and alternative assets, along with regular public securities.

If you’re a W2 employee, then you could rollover into a self-directed IRA. If you’re self-employed full-time or part-time (without any W2 employees working for you), then you should explore Solo 401K. Please check with your CPA or financial advisor before making any investment decisions.

By completing the form and joining our private investor network, you are only indicating an interest to invest in certain real estate opportunities, and are not commiting, obligated or legally bound to purchase any securities, nor are any securities yet being offered to you.