Is a savings bank account even relevant in today’s time? In Europe, savings banks formally originated in the 19th and may have existed in some form even in the 18th century. Their original objective was to provide easily accessible savings products to all strata of the population. In some countries, savings banks were created by the government on public initiative, while in others, socially committed individuals created foundations to put in place the necessary infrastructure.

Looking at the success of these savings banks, whose primary purpose consists of accepting savings deposits and paying interest on those deposits, commercial banks also started to offer savings products like CDs, savings accounts, etc. to their clients. Even though commercial banks and savings banks provide banking and loan products to consumers, the big difference is that commercial banks unlike savings banks, work as intermediaries between the central bank (FED) and the ultimate money borrowers.

Typically, banks and financial institutions pay interest on deposits to incentivize keeping your money with them. These deposits are funneled into their lending business, where they charge higher rates. The difference is called net interest margin, a common financial industry metric.

All things equal, rates go up when demand for loans exceeds the supply of loanable funds and go down when the reverse holds true. But with central bank printing money has altered this equation. With quite literally trillions injected via quantitative easing, the money supply, or supply of loanable funds, has skyrocketed well past any expected level of demand. As a result, rates until mid 2022 were near all-time lows.

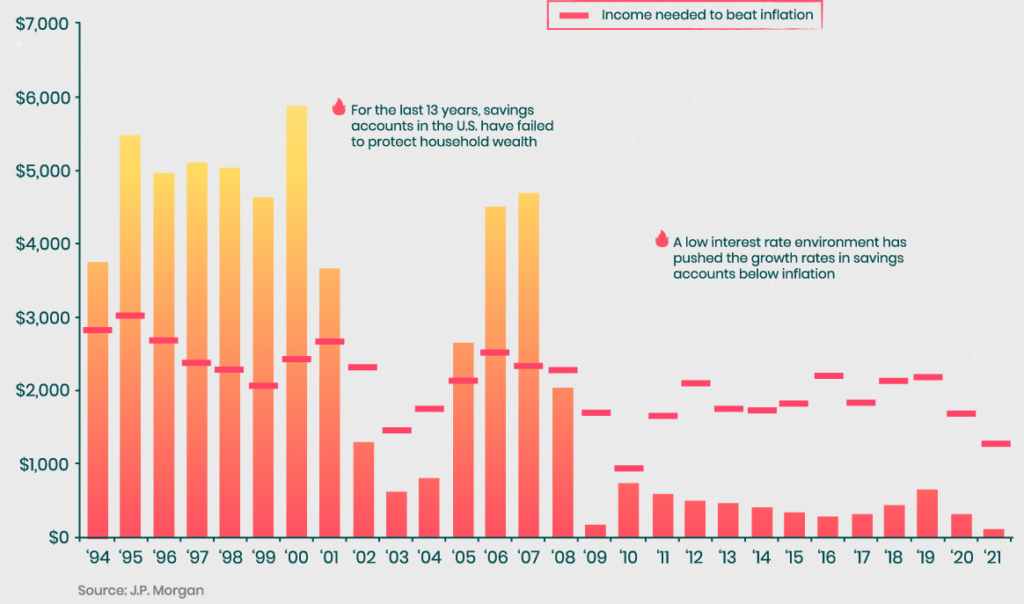

This below chart shows how a typical savings account in the United States has failed to even match the depreciation of the dollar, let alone creating any household income or wealth.

At the time of writing this article the average U.S. personal savings account returns about $100 annually, or 0.1% per $100,000 in interest income on deposits with a national bank like J.P. Morgan Chase, Bank of America, and about 4.25% in a high-yield savings account or CD with regional or local banks like PNC, Citizens Bank.

Yes, your money is very safe & secure up to $250K in a FDIC insured savings account, but what about growth? Instead of growing in value your money loses value every year in a savings account due to inflation and a depreciating dollar!!

Conclusion:

In our opinion, depending on your age and risk appetite, you should have a liquidity of 6 months to 2 years of living + medical expenses in your bank & liquid investment accounts, and invest the rest in assets that give a return equal to or preferably higher than the prevailing annual inflation. In the recent history, inflation in U.S has been around 2-3% but for the last 3 years it has ranged from 4% to 9%, or average ~7%. Considering the high inflation for last few years, with a nominal return of 0.1% on a savings account, the real return is negative. Similarly, bonds & other fixed income investments, including Bank CDs (which are FDIC insured up to 250K) have an annual nominal return of ~4.0%, the real return would be negative. Even equity investments, including mutual funds have an annual nominal return of ~8-10%, the real return would be barely positive. Income generating commercial real estate (which is what we buy) generally provides an annual average return of ~10-12% over the holding period, thereby providing a positive inflation-adjusted return, tax savings & also periodic cash flow. Please consult your financial advisor or tax professional before making any investment decisions.

Collective thinking benefits all. What are your thoughts & insights on this topic? Please share them here or email us

References: https://www.chase.com/ – https://www.wikipedia.org/ – https://elements.visualcapitalist.com/