Retirement is often one of the most common, yet important goal that people have. Your retirement savings will determine how comfortably you will live and whether your money will, outlive you.

The most common vehicles of retirement savings for a working individual are broker directed and managed Traditional IRA, Roth IRA, Employer 401(k), 403(b), 457, SEP IRA, Keogh, etc. Roth IRA is used for a post-tax savings strategy. All others are used as a pre-tax savings strategy.

IRA, 401(k) plans can be self-directed. If you’re an individual who knows and wants to manage how and where your retirement savings are deployed, the self-directed option could be ideal for you. This is a great option for individuals who would like to directly invest their savings in real estate and alternative assets, along with regular public securities.

If you’re a W2 employee, then you could rollover into a Self-directed IRA (SDIRA). If you’re self-employed full-time or part-time (without any W2 employees working for you), then you should explore Solo 401K. SDIRA custodian accounts have been in existence since 1980’s, until the Checkbook control was introduced in the 2000’s. Passing of the new Pension Protection Act launched Solo 401k into the spotlight. Starting 2006, this new law made it possible to rollover funds into a 401k, just like a Rollover IRA.

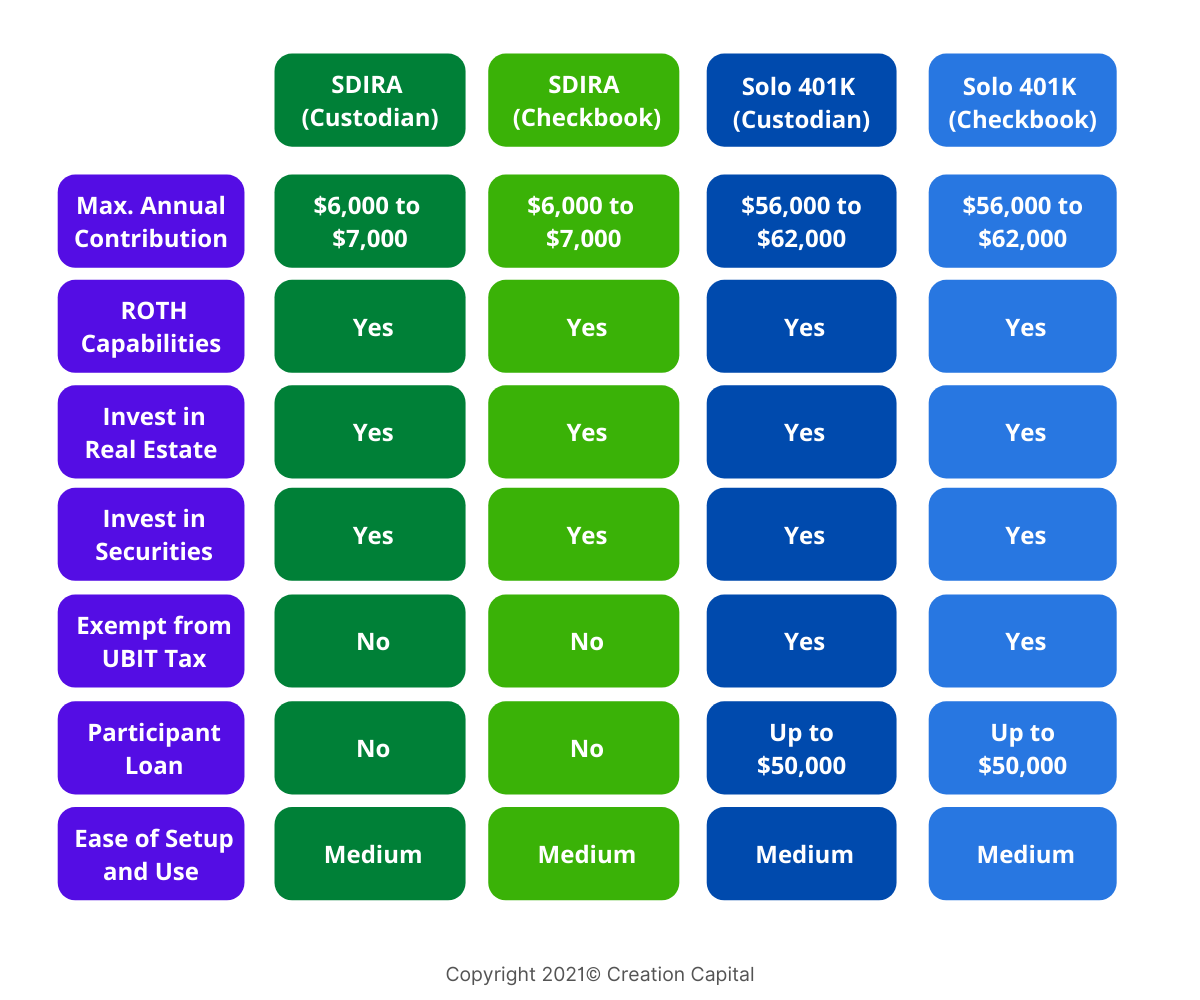

Below chart summarizes key features of each plan.

A few investors from our network wanted to know more about investing in our real estate fund offering though their retirement accounts. So we called up a few custodian companies and short-listed the below 1 company, that was prompt in responding to our questions, and agreed to offer a discount to our investor network.

Please take note that this is in no manner a recommendation or promotion for this company or its services. Nabers Group is a totally independent company and we have no financial and/or any other type of association with it. Please direct all your questions about setting up and managing a SDIRA or Solo 401K account to Ilana. We strongly recommend, you perform a thorough evaluation of this or any other custodian company you intend to work with. Also consult your financial and tax advisor before making any major investment decisions.

Nabers Group

Plans

Self-Directed IRA (SDIRA), Solo 401K

Contact

Ilana Brown – 877-765-6401 – support@solo401k.com

Discount Codes

CREATIONCAPIRA : $100 off Self-Directed IRA

CREATIONCAP401K : $50 off Solo 401K