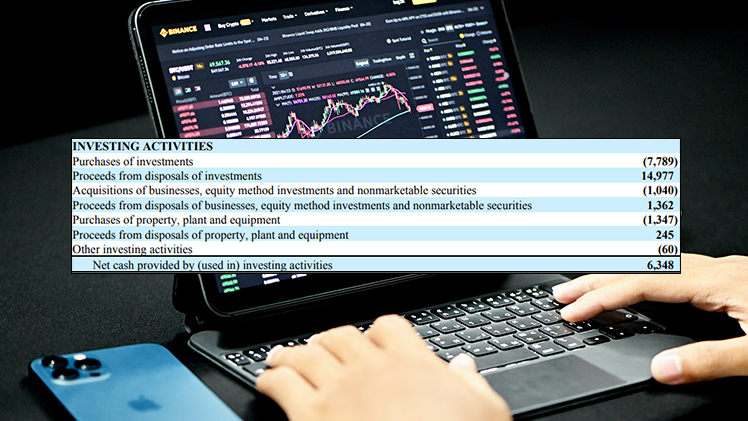

The component of a Cash Flow Statement (like the example shown above) that details how much money was made or spent on various investment-related activities during a given period is called the investing activities cash flow. Buying tangible assets, investing in securities, or selling securities or assets are all examples of investing activity. Negative cash flow frequently signals a company’s underwhelming performance. Negative cash flow from investment operations, could also result from considerable sums of money being spent on the business’s long-term success strategies, such as R&D, new plant & equipment, etc.

Reviewing an organization’s investment activity in its financial statements is critical before assessing the positive and negative Cash Flow from Investing activities (CFI). The three primary financial statements are the balance sheet, cash flow statement, and income statement. While the balance sheet displays a summary of the company’s assets, liabilities, and owner equity as of a certain date, the income statement summarizes the company’s earnings and outlays for a certain period. Finding out the money made or spent on operations, investments, and financing activities during a certain period through the cash flow statement, helps bridge the gap between the balance sheet and the income statement.

What Makes Understanding CFI Necessary?

CFI demonstrates how a firm allocates funds for the long term, where cash flow from investment operations is significant. For instance, a firm may spend money on equipment, property, and other fixed assets to expand. While this indicates a short-term decline in cash flow from investment operations, it could support the company’s long-term ability to create higher cash flow. To increase profits, a business may even consider investing capital in short-term marketable securities.

Components of a Cash Flow Statement

There are three components of a cash flow statement:

- Cash Flow from Financing Activities (CFF)

- Cash Flow from Investing Activities (CFI)

- Cash Flow from Operating Activities (CFO)

In the CFO section, net income is adjusted for non-cash costs and changes in net working capital. The financial effect from the purchase of non-current assets like fixed assets (Property, Plant, and Equipment, commonly abbreviated as PP&E, investments into stocks and bonds, and Mergers & Acquisitions) is computed in the part after that, known as the CFI section.

Cash calculation from investing portion is simpler than the cash from operations since it just tracks the cash inflows and outflows associated with long-term investments and fixed assets during a certain period.

Formula for Calculating Cash from Investing Activities

Buying fixed assets such as PP&E comes under Capital Expenditures or Capex, which is frequently the biggest cash outflow and a necessary, ongoing expense for the company model. Cash flow from investing can be calculated in the following manner:

CFI= (Purchase of Long-Term Investment) + Capex + (Business Acquisitions) – Divestitures

Positive and Negative Cash Flows

- If the CFI section is positive, the corporation is probably selling off assets, which raises the business’s cash balance (i.e., sale proceeds).

- If CFI is negative, on the other hand, the business is probably making significant investments in its fixed asset base to increase revenue in the upcoming years.

A negative cash flow from investment does not always indicate management is not investing in the company’s future and long-term growth.

Cash Flow in Real Estate

Income and costs are the two primary factors you need to completely understand and forecast when looking at a real estate investment. You can precisely define cash flow real estate investing by understanding a property’s financials. The amount of profit you make each month after collecting all income, after covering all operational costs, and setting away cash reserves for upcoming repairs is known as your cash flow. Cash flow is the main tool utilized by buy-and-hold real estate investors to boost revenue.

Factors Affecting Real Estate Cash Flow

- Tenant Evictions When a tenant vacates, there are cleaning or repair costs also known as churn, which are not covered by their security deposit. Tenant evictions where a tenant is forced to vacate are detrimental to cash flow.

- Unpaid Rent Your renter could occasionally fail to pay their rent on time or not pay. When a renter does not pay in whole, your cash flow is significantly decreased, and if they skip a payment, it is completely gone. Additionally, you are now required to pay for all expenditures out of your own money (mortgage, if you have one, insurance, taxes, etc.). Plus, if they do not pay consistently you might have to initiate eviction proceedings that come with additional legal costs and time.

- Maintenance and Repairs Nobody enjoys replacing a furnace or fixing a leaky roof, though such expenditures are inevitable, however, they will occur. It is best to keep a part of your monthly income aside to cover these unforeseen expenses. However, there are situations when cash reserves are insufficient to pay certain costs, forcing you to use cash flow income or personal funds.

- Raising Rent The easiest method to improve cash flow is to increase rent. Purchase a property that is not operating well (where rentals are lower than prevailing market rents) and adjust the lease to reflect market rent. Alternately: you might update a property’s appearance and features by renovating it to ask higher rents.

- Property Tax Review Depending on the market, it may make sense to file an appeal with the local government for property tax reassessment, if you believe the rise in taxes was unreasonable.

Thorough study of a cash flow statement is necessary before acquiring any business or real estate. It ensures that you are valuing the business or real estate correctly and not overpaying for it.

Disclaimer: This is in no way an investment advice or solicitation. Please consult your CPA or an investment professional before making any investment decisions.