“I didn’t have it, but I want my children to have it all” – Does this sound familiar? Be it money, wealth, comfort, education, or anything else for that matter. In most cases, we want our children and loved ones to live a better life than what we did or have. But to fulfill this emotional desire, we first need to understand and go through the various stages and types of human needs.

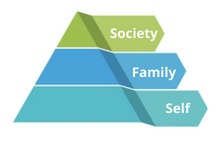

Back in 1943, Abraham Maslow an American psychologist published his paper “A Theory of Human Motivation”, that walks us through the types and hierarchy of needs. In his paper, Maslow talks about the 5 tiers or stages of needs that motivate people. At the very bottom of the pyramid are deficiency needs, and as they’re met, one moves towards the top of this pyramid in fulfilling growth needs.

Deficiency needs

- Physiological – food, shelter, clothing, sleep, etc.

- Safety – security, employment, health, property, etc.

- Love & Belonging – friendship, love, relationship, family, etc.

- Esteem – respect, freedom, status, recognition, strength, etc.

Growth needs

- Self-actualization – self-fulfillment, personal growth, experiences, etc.

This hierarchy or structure is not nearly as rigid as listed above. The order of needs could be flexible and continuously overlapping each other based on external circumstances or individual differences. It is also observed that motivation decreases with fulfillment of our deficiency needs. Whereas motivation increases as our growth needs are met.

In our opinion, the real why for building generational wealth is not just buying expensive stuff, living it up, or simply amassing wealth. It’s about staying motivated by fulfilling our self-actualization (growth) needs. These growth needs could be different for different people, and that’s why everyone’s why is different and distinct. It could be giving back to society, community service, leaving a legacy & wealth for future generations, or any other self-actualization need or desire. Our journey is to figure out, what and how to get there.